Thank you for visiting my website. You will find information about my work and my activities as the Member of Parliament on behalf of the people of Walsall South. You can contact me directly through the website and find details about my office. Owing to Covid-19 I am unable to meet at surgeries, and I am now conducting telephone surgeries. I use the House of Commons Parliamentary answering service when my office is busy or out of hours. Please leave your message with them and remember to give your name, address and contact details. The Answering Service will send me an email with your message

If you have any problem or issue you think I may be able to help you with, please do get in touch.

Please note that Members of Parliament are not an emergency service so do contact the appropriate emergency services when required.

I would like to thank the NHS for their wonderful service during the pandemic.

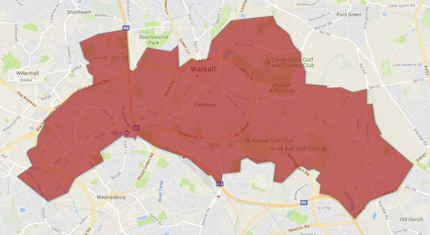

About Walsall South

Do you live in the constituency? Follow the link below to check that Valerie is your MP.

Press Releases

Keep updated with the latest news locally, media coverage and news from Parliament.

In November and December, I chaired five sessions of the Employment Rights Public Bill Committee, including an evidence session, 26 November, 3 December, 12 December – two sessions, 17 December.

The Employment Right Bill seeks to: ensure that jobs provide a baseline of security for workers, prioritise fairness, equality and wellbeing of workers, ensure workers get fair pay for a fair day’s work, modernise trade union legislation giving trade unions greater freedom to organise, represent

and negotiate on behalf of their workers, improve enforcement of employment rights and establish the Fair Work Agency to bring together existing state enforcement functions including the enforcement of the National Minimum Wage and Statutory Sick Pay. The Fair Work Agency will also incorporate a wider range of employment rights, such as holiday pay.

The House of Commons appoints committees to consider proposed legislation in detail, line by line. Once the committee finishes looking at the Bill, it will report its conclusions and any amendments made to the House where it will be debated further on the next stages of the Bill.

On 17 December 2024 the House debated and voted on amendments relating to the National Insurance Contributions Bill.

The Bill, introduced on 6 November 2024, seeks to ask employers to contribute more. This means, from April 2025, the rate of Employer NICs will increase to 15%, and the per-employee threshold at which employers become liable to pay NICs on employees’ earnings will be reduced to £5,000. The government will protect many of the smallest businesses by increasing the Employment Allowance to £10,500. More than half of employers will see no change overall from these measures in the next tax year. Eligibility for the Employment Allowance will also be expanded to allow more businesses to claim, with the removal of the threshold of £100,000 of employer NICs bills in the previous tax year.

Amendment 13: The amendment provides adult social care, hospice, primary care, nurseries and charities would continue to pay contributions at current rates. The votes were Ayes: 206, Noes: 353

Amendment 23: This amendment would exempt veterans’ salaries from NICs changes. The votes were: Ayes: 196, Noes: 352

New Clause 1: This clause would require the Chancellor of the Exchequer to, within a year of this Act being passed, publish an assessment of the impact of the changes introduced by this Act on rates of employment, real wages, inflation, and real household disposable income. The votes were : Ayes: 195, Noes: 353

The Bill's second reading is debated in the House of Lords.

The Financial Bill was debated and voted on in a Committee of the whole House on 10 and 11 December 2024. A number of proposed amendments were debated, and the following clauses were voted on:

New clause 5

The Bill as introduced stated in section 8 that from 6 April 2025, the Capital Gains Tax (CGT) rate for Business Asset Disposal Relief increases from 10% to 14%. Any references in the tax legislation to the 10% rate will also be updated to 14%. From 6 April 2026, the CGT rate for Business Asset Disposal Relief will increase again, from 14% to 18%, and references in the legislation to the 14% rate will be updated to 18% accordingly.

The new clause proposed that the Chancellor must prepare and publish a review of how the changes in Section 8 affect the number of Business Asset Disposal Relief claims for business sales, and that the review should compare the number of claims in the 2024-25 tax year to those in 2025-26 and compare the impact of the new rate with what would have happened if the rate had stayed the same.

I voted against the clause with the result: Ayes 105, Noes 340

New clause 2

This new clause would require the Government to produce a report setting out the fiscal impact of the Bill’s changes to the Energy Profits Levy investment expenditure relief.

I voted against the clause: the result: Ayes 74, Noes 350

New clause 3

This new clause would require the Chancellor to publish a review within three months of this Act taking effect, assessing the expected impact of the measures in sections 15 to 18 on employment in the UK oil and gas industry, capital expenditure in the UK oil and gas industry, UK oil and gas production, UK oil and gas demand, and the Scottish economy and economic growth in Scotland.

I voted against the clause with the result: Ayes 184, Noes 359

The Bill will now be scrutinised at Committee stage, with the date to be announced.

On Tuesday 10 December 2024 the House voted to approve a number of pieces of delegated legislation:

Draft Financial Services and Markets Act 2023 (Addition of Relevant Enactments) Regulations 2024, which were introduced to the House on 31 October.

These Regulations expand the list of "relevant enactments" under sections 13 to 17 of the Financial Services and Markets Act 2023, allowing the Treasury to create an "FMI sandbox," which can adjust how these enactments apply to test new technologies or practices in financial market infrastructure activities. This change adds new enactments to the list in section 17(3), enabling them to be modified in future FMI sandboxes.

Draft Building Societies Act 1986 (Modifications) Order 2024, which was introduced to the House on 14 October.

This Order amends the Building Societies Act 1986 to align the rules for building societies with those for companies regarding directors’ retirement and balance sheet signatures. It repeals provisions mandating a normal retirement age of 70 for building society directors, compulsory retirement age rules, and related criminal penalties, bringing building societies in line with companies, where age-related restrictions no longer apply following changes introduced by the Companies Act 2006. Additionally, the Order modifies the balance sheet signature requirements, allowing a building society’s balance sheet to be signed by one director on behalf of the board, instead of by two directors and the chief executive, aligning with company requirements under the 2006 Act.

Draft Double Taxation Relief and International Tax Enforcement (Ecuador) Order 2024, which was introduced to the House on 11 November.

This Order will provide a clear and fair framework for the taxation and administration of cross-border transactions between the United Kingdom and Ecuador, benefiting businesses and the economies of both countries by removing barriers to cross-border trade and investment.

Draft Home Detention Curfew and Requisite and Minimum Custodial Periods (Amendment) Order 2024, which was introduced to the House on 13 November.

This Order changes the eligibility for Home Detention Curfew, allowing prisoners serving fixed-term sentences to be released up to 365 days before completing their requisite custodial period, instead of 180 days. The requisite custodial period is adjusted for certain offences, reducing the release threshold to 40% of the sentence instead of 50%, with six additional offences excluded from this reduction. The Order applies to both current and future prisoners who have not reached their release point but excludes those already released under specific provisions unless they are recalled. Balance adjustments are also made to ensure consistent application of these rules.

Results:

Ayes 424 Noes 106

To celebrate International Human Rights Day which falls on 10 December 2024, I attended Amnesty International’s Annual Human Rights Day Reception in Parliament.

I joined other Members of Parliament, staff and campaigners from Amnesty International to celebrate historic human rights achievements.

I was delighted to catch up with Anoosheh Ashoori whose incarceration I raised every week in Parliament at Business Questions when I was Shadow leader of the House. (below left). His case together with Nazanin Zaghari-Ratcliffe showed what Parliamentarians with civic society can achieve and this year’s event provided Members of Parliament a moment to reflect on and celebrate those achievements. Now we have to raise the case and release of Alaa Abd El-Fattah. Amnesty has been at the forefront of the debate from adopting wide-ranging equality legislation to bringing about the Arms Trade Treaty.

We need Amnesty more than ever in this fractured world and must never let our hard fought Human Rights slide.

Videos

Covid Memorial Wall

20mph Speed Limits

RAF Centenary Flypast