Thank you for visiting my website. You will find information about my work and my activities as the Member of Parliament on behalf of the people of Walsall South. You can contact me directly through the website and find details about my office. Owing to Covid-19 I am unable to meet at surgeries, and I am now conducting telephone surgeries. I use the House of Commons Parliamentary answering service when my office is busy or out of hours. Please leave your message with them and remember to give your name, address and contact details. The Answering Service will send me an email with your message

If you have any problem or issue you think I may be able to help you with, please do get in touch.

Please note that Members of Parliament are not an emergency service so do contact the appropriate emergency services when required.

I would like to thank the NHS for their wonderful service during the pandemic.

About Walsall South

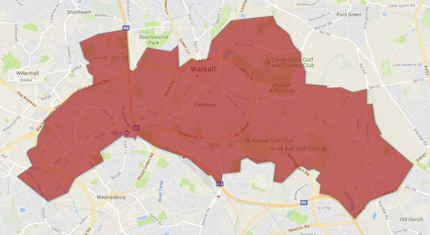

Do you live in the constituency? Follow the link below to check that Valerie is your MP.

Press Releases

Keep updated with the latest news locally, media coverage and news from Parliament.

I hosted and opened the Indo-UK Global Business Awards at the House of Commons on 21 November 2024 with a speech before the evening of awards. In my speech I said: “It is vital for our community to come together andengage with Parliament, not only to hear from parliamentarians but also to facilitate meaningful exchanges with individuals visiting from India and members of the Indian diaspora in the UK. (picture with Virendra Sharma former for MP Ealing Southall.) India’s growing global significance, with its rapid economic growth projected to outpace other nations in the coming years, underscores the importance of strengthening this partnership. Building friendships and maintaining open dialogue are crucial for fostering an exchange of ideas and perspectives. (Picture right all the award winners).

These efforts will enhance trade opportunities and cultural collaboration, ensuring a deeper connection between the two nations. By bringing people together, we can create a platform for shared understanding, cooperation, and the celebration of our vibrant cultures." (picture left Neeraj Bansal Head India Global - KPMG in India) All the awardees were inspiring both in terms of their entrepreneurship and their charity work. It was encouraging to see girls' education and social activism among the values celebrated, and I look forward to witnessing the growth of Indian and British relations in the years to come.

On 19 November 2024, the House voted on amendments from the Lords to the Passenger Railway Services (Public Ownership) Bill. This Bill aims to make provision for passenger railway services to be provided by public sector companies instead private franchises.

The results were as follows: Lords Amendment 1 - Motion to disagree

The House divided: Ayes: 344 Noes: 172 Lords amendment 1 disagreed to.

Lords Amendment 2 - Motion to disagree

The House divided: Ayes: 350 Noes: 108 Lords amendment 2 disagreed to.

Lords amendment 3 agreed to.

The amendments will now be considered before Royal Assent is given.

On Tuesday 19 November 2024 I chaired the debates held in Westminster Hall from 9.30-11.30am.

The first motion, moved by Seamus Logan MP was 'That this House has considered the use of foodbanks', and was responded to by the minister Alison McGovern MP.

The second motion, moved by Jim Allister MP was 'That this House has considered the Windsor framework', and was responded to by the Secretary of State for Northern Ireland, Hilary Benn MP.

On 14 November 2024, I intervened in the debate on the Lords Spiritual (Women) Act 2015 (Extension) Bill, which aims to increase female representation among the bishops who sit in the House of Lords. It seeks to extend the provisions of the 2015 Act for a further five-year period, allowing vacancies among the lords spiritual to be filled by female diocesan bishops if available.

I made the following contribution:

I thank the Minister, who is doing a fantastic job of ensuring, through the Bill, that women are represented at every level; in the 21st century, we should not be talking about firsts for women.

In the spirit of colleagues who have intervened already, may I ask my hon. Friend to recognise the brilliant role played by the first black woman to be Speaker’s Chaplain here in the House of Commons? The Reverend Rose Hudson-Wilkin then rose to be Bishop of Dover; I am thinking also of the Reverend Tricia Hillas, who also served as Speaker’s Chaplain. Parliament is seen as an important place for the representation of women and I very much support the Minister in ensuring that the Bill makes progress.

The House met to debate and vote on the Non-Domestic Rating (Multipliers and Private Schools) Bill on Monday 25 November.

This Bill, introduced to the House on 13 November 2024, amends the non-domestic rating system in England to enable the introduction of new tax rates, introducing powers to create new lower tax rates for qualifying retail, hospitality and leisure properties, higher tax rates for the high value properties, and removes the eligibility of private schools that are charities for charitable business rates relief.

An amendment was moved to block a second reading based on objections to the measures aimed at private schools, and the result was: Ayes: 173, Noes: 335. The House then voted on the second reading, with the result: Ayes: 334, Noes: 174.

The Bill will now be scrutinised in a Public Bill Committee.

Videos

Covid Memorial Wall

20mph Speed Limits

RAF Centenary Flypast